China’s Tech Sovereignty Drive: What Investors Need to Know

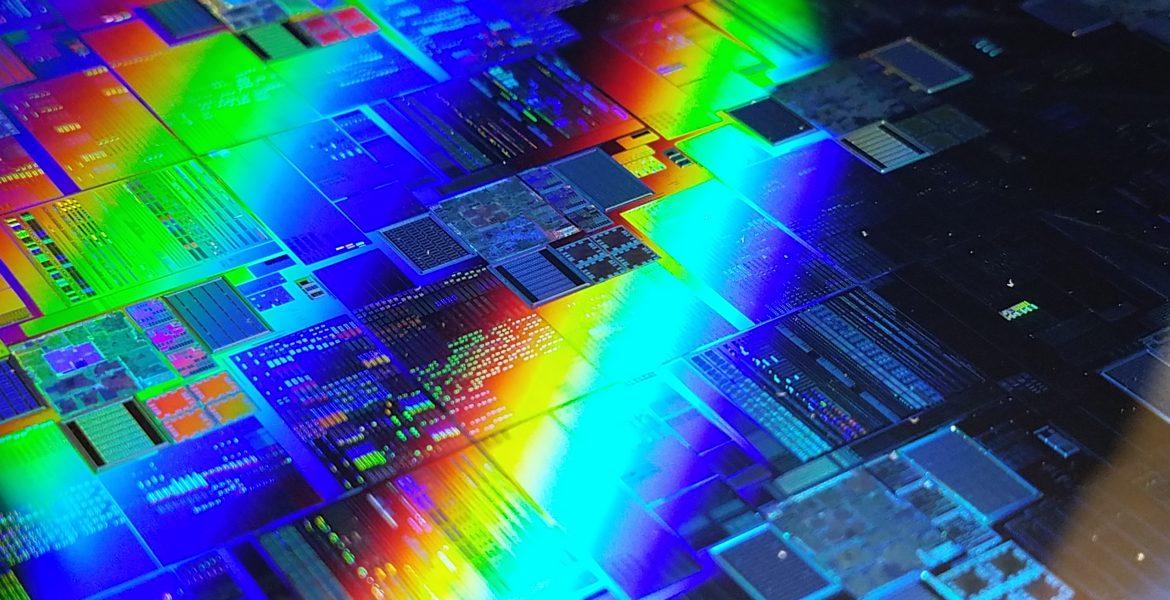

China’s push for technology sovereignty in 2025 has shifted from ambition to necessity. As Washington tightens restrictions on advanced semiconductors and software, Beijing is accelerating the construction of a domestic tech stack that can withstand sanctions. National champions such as SMIC, Huawei, and BYD stand at the core of this strategy, which is designed to ensure resilience, survival, and ultimately long-term growth.

Why tech sovereignty matters

Technology today is no longer just about expansion; it has become about security. Semiconductors, AI, and cloud infrastructure are treated as strategic assets. Therefore, Beijing’s sovereignty drive reflects the dynamics mapped in our China Tech Sovereignty hypothesis, where access to technology defines power in a multipolar world. At the same time, this effort echoes our Defense & Tech Autonomy thesis, which highlights how security and innovation are converging worldwide.

Implications for investors

For investors, the opportunities are visible across multiple sectors. State-backed firms benefit from subsidies, guaranteed markets, and reduced foreign competition. Consequently, EVs, batteries, and domestic chipmakers are positioned for scale. However, the risks are equally significant: sanctions shocks, supply-chain decoupling, and potential overcapacity in semiconductors or green technologies. Selective exposure — combined with prudent hedging — is therefore essential.

A fragmented ecosystem

The pursuit of sovereignty is driving fragmentation across the global economy. Supply chains are splitting, standards are diverging, and capital is flowing into parallel systems. This extends beyond chips into the future of the internet, AI regulation, and digital trade rules. As a result, investors must adapt to ecosystems that may never reconcile. The logic is embedded in our scenario planning framework, particularly in the trajectories of Peaceful Transition, Engineered Crisis, and The Great Unwinding.

Final thought

China’s sovereignty drive is not a passing phase but a structural shift. For Beijing, it is about resilience and control. For investors, it represents both volatility and selective opportunity. In the wider world, it is one of the defining forces shaping the transition to a multipolar economy.

You may also like

NATO-Russia Tensions and Self-Interest

US Shutdown – an Engineered Constitutional Crisis?